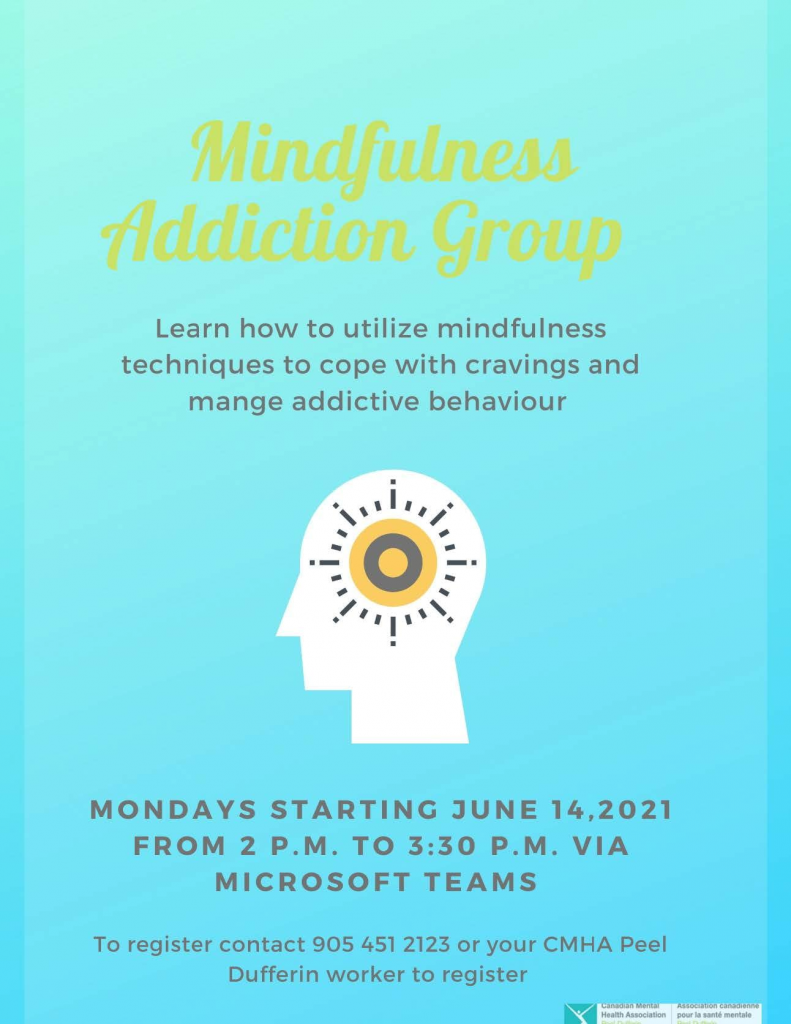

EAP – Mindfulness Addiction Group

|

As we continue to navigate the global pandemic, many have become numb or indifferent to the challenges we face and manage on a daily basis. For many, we’ve entered a state of rinse and repeat with a lack of simple motivation or enthusiasm. This state of stagnation with feelings of emptiness is known as languishing.

In support of our customers and your employees across the country, on Tuesday, June 15th and Thursday, June 17th, Homewood Health will be hosting a webinar focused on languishing and its association with poor mental health: COVID-19: What is Languishing and Why is it Important? In this session, Homewood Health will discuss the impact languishing has on our mental health, while providing tools and tips to manage our current experience with the COVID-19 pandemic. Please join us for this special event. Dr. Sandra Primiano, Ph.D., Psy.D, Vice President, EFAP and Counselling Services Dr. Primiano is responsible for providing leadership to the Employee and Family Assistance Program (EFAP) and Counselling Services, where she collaborates with clinical leaders across the organization to implement clinical processes, ensure service quality and clinical effectiveness of EFAP and Counselling Services. Dr. Primiano graduated from the Université du Quebec à Montréal (UQAM) with a Ph.D. and Psy.D. in Clinical and Experimental Psychology. She came to Homewood from Veterans Affairs Canada (VAC), where she was a Psychology Consultant for the Directorate of Mental Health. Her responsibilities included the development, delivery and coordination of evidence- informed mental health services in the (11) Operational Stress Injury Clinics across Canada. |

|

|

|

Homewood HealthTM EFAP is pleased to release the Life Lines article for June 2021, “Healthy Relationships” .

This article is intended to support your wellness programming by providing employees and their family members with useful information and tips. Suggested distribution mechanisms include posting it on your intranet site, printing hard copies to be placed in high traffic areas such as staff lounges and lunchrooms, making it available in Human Resources and occupational health centres, mass email distribution, or including within your company communications.

Understanding the complexities and demands of your day, Homewood Health is pleased to provide article summaries in both video and audio file formats. Each file is approximately two minutes in duration and reviews key reading points in a clear and concise manner. Please click on the tabs below for access.

| View the Article |

| Play the Video |

| Download the Audio File |

Due to high demand, Part I of the “Retirement – Are You Ready” webinar will be offered once again, in English, on April 27th from 1200-1345 EDT.

Part I

Are you retired or thinking of retiring? Are you ready? There are many aspects to retiring, and it is important that you are prepared. In 2000 18% of retirees retired with debt. That number is now projected to be 67%. Maybe not so coincidentally 67% of retirees continue to support their adult children. 47% of retirees worry about debt in retirement and the credit bureaus rank the 55+ and 65+ age groups as being at the highest level of risk for delinquencies and bankruptcies. Come to our session, Retirement – Are You Ready Part I and learn what steps you should take to identify your debt and steps to tackle it. Examine your sources of income, their respective tax implications and other areas of importance.

PLEASE NOTE: This presentation will be about things you need to look at going into retirement. The presenter is not an Air Canada employee and will not be able to answer any questions regarding the current Retirement Incentive from the Company.

To register for Part I of the “Retirement – Are You Ready” Webinar, please email mindfulness@accomponent.ca. In your email please include your full name and employee number.

– – –

As a reminder, Part II of the “Retirement – Are You Ready” Webinar is currently only available in English and will run on April 29th from 1200-1330 EDT.

Part II

At any age, but especially as you approach retirement, there are certain items that we all need to attend to but put off. Are you financial and household papers in order? If you were to pass now would your spouse, your Executor be able to figure things out or would they have to deal with a mess of papers while struggling with their grief? Are you comfortable with the differences between an Executor, a Power of Attorney, and a Health Care Directive? Are you familiar with Wills, Probate, the cost of Probate and how to bypass this cost? What happens to your debts when you pass, do they go to your spouse and other survivors? Is there a way to help minimize costs associated with estate settlement? Come to our session, Retirement – Are You Ready Part II and learn the answers to these and other questions.

To register for Part II of the “Retirement – Are You Ready” Webinar click on the following link:

https://forms.office.com/r/BErNu1LGmy

In Solidarity,

Mary Keough

Chair, Component EAP Committee

As a result of the announcement earlier this week regarding the Early Retirement Incentive Program, we have decided to change the topic of the webinar scheduled for April 22, 2021. The Truth About Credit webinar which was originally scheduled for April 22nd will be moved to June 10, 2021. In its place we are pleased to offer you the “Retirement – Are You Ready” two-part webinar through the Credit Counseling Society.

Part I will be offered in English and French on April 22nd from 1200-1330 EDT.

Part II is currently only available in English and will be run April 29th from 1200-1330 EDT.

Part I

Are you retired or thinking of retiring? Are you ready? There are many aspects to retiring, and it is important that you are prepared. In 2000 18% of retirees retired with debt. That number is now projected to be 67%. Maybe not so coincidentally 67% of retirees continue to support their adult children. 47% of retirees worry about debt in retirement and the credit bureaus rank the 55+ and 65+ age groups as being at the highest level of risk for delinquencies and bankruptcies. Come to our session, Retirement – Are You Ready Part I and learn what steps you should take to identify your debt and steps to tackle it. Examine your sources of income, their respective tax implications and other areas of importance.

Part I will be offered in English and French on April 22nd from 1200-1330.

Part II

At any age, but especially as you approach retirement, there are certain items that we all need to attend to but put off. Are you financial and household papers in order? If you were to pass now would your spouse, your Executor be able to figure things out or would they have to deal with a mess of papers while struggling with their grief? Are you comfortable with the differences between an Executor, a Power of Attorney, and a Health Care Directive? Are you familiar with Wills, Probate, the cost of Probate and how to bypass this cost? What happens to your debts when you pass, do they go to your spouse and other survivors? Is there a way to help minimize costs associated with estate settlement? Come to our session, Retirement – Are You Ready Part II and learn the answers to these and other questions.

Part II is currently only available in English and will be run April 29th from 1200-1330.

Click on the following link to register for the webinars listed above:

https://forms.office.com/r/BErNu1LGmy

Please note you must register for each webinar.

In Solidarity,

Mary Keough

Chair, Component EAP Committee