If you have ever heard the saying, “what goes around comes around” … your WAGE INDEMNITY PLAN (WIP) faces the same financial distress that it did in the mid-90s.

The Wage Indemnity Plan in the mid-90s experienced limited cash flow and high claims which equated to a debt of $8 million. To alleviate a portion of the debt the Board at the time chose to implement a dramatic change to the plan and added the 15 weeks of employment insurance, (EI) to the program. The change was not well received by the members. During the introduction of the EI program members were only able to collect the amount of money that was provided by EI (and no top-up). After several changes over time the Board was able to do a full top up to ensure members maintained 60% of their gross earnings, which is what we do today.

Since 2010, your Board of Trustees has given back to you, the members, more than $16 million in Contribution Holidays. The reason for the Contribution Holidays was an equitable disbursement of the surplus funds. The trust fund had sufficient cash flow to support contributions in and claims paid out. There were no contribution increases and the plan had a decrease in 2013 from 2.98% to 2.3% due to the plan’s financial stability. Over time our population increased as did the claims commencing in 2018. The claims exceeded the contributions, however the fund surplus compensated for the short fall. Then in 2020, we encountered something we could never have imagined, COVID.

COVID affected the world economy and took workers in every field by storm. In today’s world the pandemic has blindsided everyone and has put your WIP plan in a similar position as in the mid-90s. Over the course of the next two years, we find ourselves with an “estimated” deficit that is likely to exceed over 6,000,000.00 dollars. The number of claims over the course of 2020 and 2021 have been exorbitant and costly. Thus far in 2022, the pattern continues.

The Board of Trust monitored the WIP financials and the effects that the pandemic asserted on the plan surplus. The monthly receivables from Air Canada and the membership went from $1 million a month to $233,000. Members on claim did not decrease and the claims experience exceeded the monthly remittance from Air Canada. It became apparent that it was impossible to maintain a cash flow to cover the monthly costs due to the short fall in funds. We have essentially survived the pandemic by utilizing the surplus.

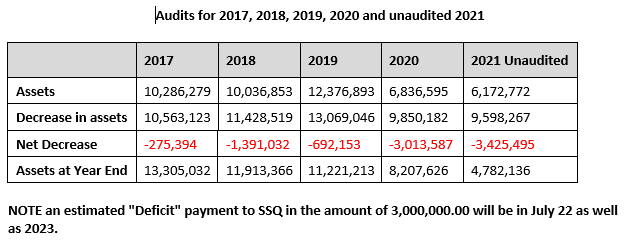

Below you find the costs associated in running the plan from 2017/2018/2019/2020 and an unaudited year for 2021. (Click HERE to view a PDF of the chart).

Claims paid versus contributions received are higher than the premiums paid to SSQ financial, our insurer, which have created ongoing deficits. These deficits became exponential as the Pandemic continued. The insurer looks at the past 10-year history to determine what the premiums will be. What this means from a financial perspective is that the last 3 years (2020-2023) will be part of the calculation that determines the monthly premium until 2033. This means the unfortunate 3 years attached to COVID-19 will affect our plan until 2033.

The Board of Trust has evaluated several cost saving administrative changes to be implemented effective April 1st. (Click HERE to view the bulletin).

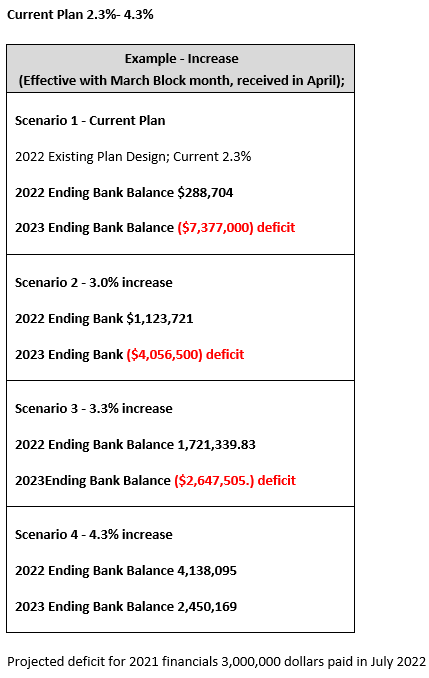

Additionally, the Board of Trustees has concluded that to alleviate the deficit and create a solvent plan the contribution rates from members will increase an additional 2%.

Effective with the MARCH BLOCK MONTH, 4.3% of earnings will be deducted and paid to the Air Canada Component of CUPE WIP visible on the April 17th pay summary and going forward.

Your Board of Trustees are confident that with this increase during 2022/2023 we will establish financial stability and have the opportunity in the future to consider reducing the monthly contributions paid by you, the member.

We trust this bulletin and the attached information will help you understand the rationale for these necessary changes.

Below is a rate comparison of the current rates at 2.3%, 3.0%, 3.3% and 4.3% indicating the end balance for each scenario under the current plan for 2022 and 2023. (Click HERE to view a PDF of the chart).

On Behalf of The Board of Trust,

Patricia Eberley

Administrative Consultant

Manion, Wilkins & Associates

Plan Administration

626-21 Four Seasons Place

Etobicoke, Ontario

M9B 0A6

Switchboard: 416-234-5044

Toll Free Line: 1-800-663-7849

Fax: 416-234-0127

Contact Centre: 1-866-532-8999