Pension Committee Update – October 2022

Thinking of taking a leave?

Remember to think about the impact on your retirement, too!

In the summer of 2021, over 420 members participated in the Early Retirement Incentive Program (ERIP).

There could have been a few more members possibly participating in the ERIP program. Unfortunately, there are some that did not buyback their pension following their leaves; this attributed to lacking the required numbers in order to be able to retire early.

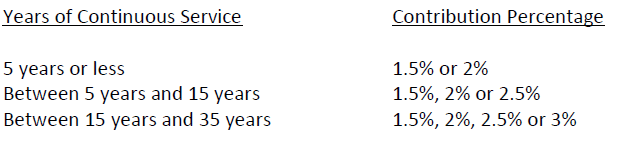

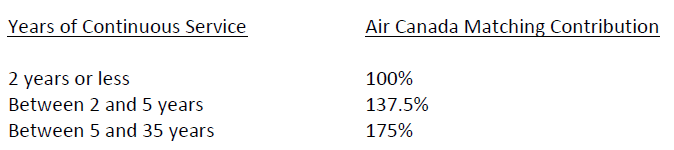

This bulletin is to remind members that if you take a leave, at any point in your 35 years of serviceable time, (members stop contributing into their pension plan after 35 years), you should take the time to seriously consider buying back your pension.

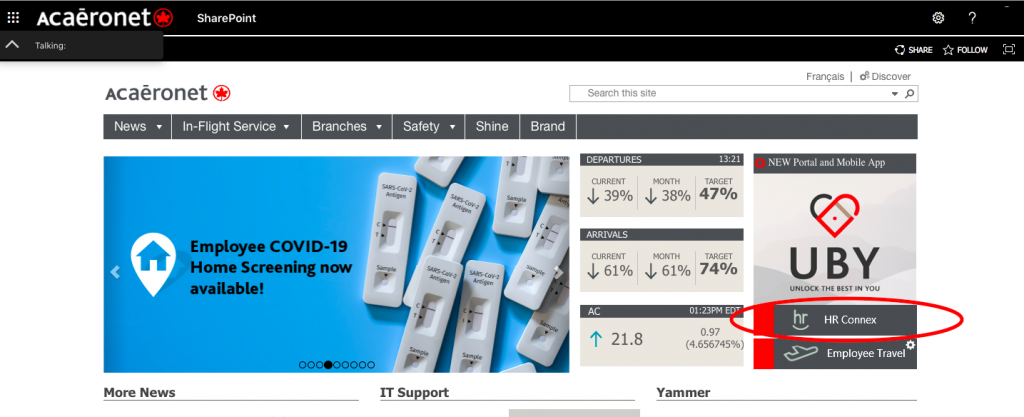

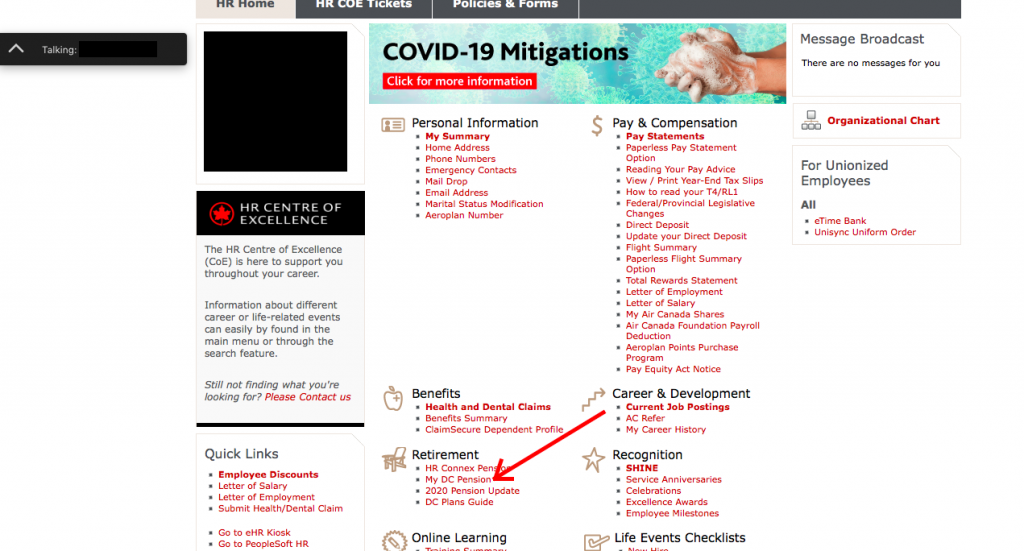

After a leave of absence, or after participating in a reduced block program, please call 1-855-538-7799 to speak to an Alight representative, whether you are on a Defined Benefit or Hybrid pension plan.

Note: Members interested in buying back service, must do so within 90 days from return to duty.

This applies for Mainline and Rouge members.

Safe travels.

Regards,

Your Component Pension Committee:

Marc Roumy (Chairperson)

Henly Larden (Member)

Caroline Lozeau Gelinas (Member)

Alex Habib (Rouge Member)

Did you know?

The number of members who retired within June, July, and August of 2021 by participating in the ERIP program (429 retired), was almost the equivalent of the number of members who retired in the previous two years.

Retirement Update:

For this year, between January and October, 51 members have retired. Click HERE to look at the breakdown between bases. Best wishes to all retired members.